Is Bitcoin Mining the Key to Renewable Energy Revolution?

Bitcoin mining is widely recognized for its significant energy consumption, accounting for approximately 0.5% to 0.9% of global electricity usage. It is estimated that Bitcoin mining consumes around 160 terawatt-hours (TWh) of electricity annually, which is comparable to the total energy consumption of entire countries such as Argentina and Poland.

The energy-intensive nature of Bitcoin mining stems from its reliance on the Proof of Work (PoW) consensus mechanism, where miners compete to validate transactions and secure the network. The Proof of Work (PoW) mechanism, while energy-intensive, plays a vital role in maintaining the security and integrity of the network. Unlike traditional financial systems, Bitcoin operates without a central authority, relying instead on a decentralized network of miners who contribute computational power to maintain the timechain.

Understanding Bitcoin Mining

At its core, Bitcoin mining involves contributing computational power, known as hash power, to secure the network. The greater the amount of hash power dedicated to the Bitcoin network, the more robust its security against potential attacks. This decentralized model not only enhances the integrity of the system but also promotes a stable financial environment that is less susceptible to manipulation and fraud.

It is important to understand that Bitcoin mining is an industry that focuses on reducing costs by purchasing energy.

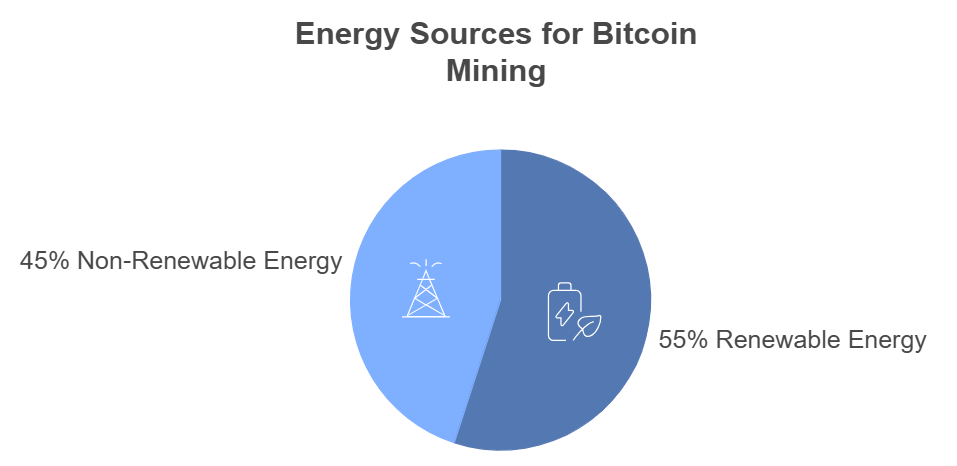

Miners often seek out cheaper energy sources, which increasingly leads them to renewable options. As a result, around 54.5% to 56% of Bitcoin mining is now powered by renewable energy, reflecting a shift towards more sustainable practices within the industry.

Moreover, this demand for electricity creates significant opportunities for renewable energy producers, particularly in areas where energy generation surpasses local consumption. By positioning themselves as flexible consumers, miners can effectively utilize surplus electricity generated from renewable sources, reducing costs while preventing this valuable energy from going to waste.

Advantages of Bitcoin Mining for Renewable Energy

Enhancing Grid Stability

One of the most significant benefits of integrating Bitcoin mining with renewable energy sources is its potential to stabilize electrical grids. The intermittent nature of renewable energy — particularly solar and wind — can create challenges for grid operators. Bitcoin mining can help mitigate these challenges by adjusting its energy consumption based on real-time supply and demand dynamics. This flexibility allows miners to act as demand-response resources, providing grid operators with a tool to balance loads effectively.

For example, during periods of high renewable generation but low demand, Bitcoin miners can ramp up their operations to utilize excess electricity. This not only reduces curtailment but also enhances the economic viability of renewable projects by ensuring that generated power is used rather than wasted.

Supporting Remote Electrification

Bitcoin mining also plays a crucial role in expanding electricity access in remote areas. In Africa and South America, initiatives are underway to establish small-scale Bitcoin mining operations powered by localized renewable energy sources. These projects create sustainable financial models for mini-grids by generating income that can be reinvested into local communities while utilizing surplus energy that would otherwise go unused.

In Ethiopia, for instance, a mining facility powered entirely by hydroelectricity demonstrates how Bitcoin mining can leverage local resources to support both economic development and renewable energy utilization. Similarly, projects in Texas are exploring how excess natural gas from oil extraction can be used for Bitcoin mining, turning what would be waste into a valuable resource.

Economic Benefits

The economic implications of Bitcoin mining extend beyond just energy consumption. By providing stable and predictable demand for power, Bitcoin mining operations offer renewable energy projects the financial stability needed to expand and innovate. This mutually beneficial relationship accelerates the development of renewable energy infrastructure as miners seek out and fund green energy solutions that support their operations.

In regions like Texas, where there is an abundance of renewable resources such as wind and solar power, Bitcoin mining can help stabilize local economies by creating jobs and attracting investment in infrastructure. The potential for job creation is particularly significant in economically disadvantaged areas that may be struggling with deindustrialization or lack of investment.

Conclusion

As the world grapples with climate change and increasing energy demands, Bitcoin mining presents a unique opportunity to drive the transition towards renewable energy. By acting as a flexible consumer of excess renewable power and supporting grid stability, Bitcoin mining can enhance the economic viability of renewable projects while promoting electrification in underserved areas.

While concerns about its environmental impact persist, the industry’s shift towards sustainable practices — such as utilizing stranded or surplus renewable energy — positions Bitcoin mining as a potential catalyst for a broader renewable energy revolution. As regulatory frameworks evolve and partnerships between miners and energy producers strengthen, Bitcoin mining could indeed play a strategic role in shaping a sustainable energy future.

Referencies:

Bhandari, R., Sessa, V., & Adamou, R. (2020). Rural electrification in Africa — A willingness to pay assessment in Niger. Renewable Energy, 161, 20–29. https://doi.org/10.1016/j.renene.2020.07.007

Bhandari, R., Sessa, V., & Adamou, R. (2023). Review and Demonstration of the Potential of Bitcoin Mining as a Productive Use of Energy (PUE) to Aid Equitable Investment in Solar Micro- and Mini-Grids Worldwide. Energies, 16(3), Article 1200. https://doi.org/10.3390/en16031200

Bloomberg. (2022). Bitcoin-Paying Solar Power Company Plans African Expansion. Retrieved from https://www.bloomberg.com/news/articles/2022-01-27/bitcoin-paying-solar-power-company-plans-african-expansion

Booth, S., Li, X., Baring-Gould, I., Kollanyi, D., Bharadwaj, A., & Weston, P. (2018). Productive Use of Energy in African Micro Grids: Technical and Business Considerations — NREL. National Renewable Energy Laboratory. https://www.nrel.gov/docs/fy18osti/71663.pdf

Bruno, A., Weber, P., & Yates, A. J. (2023). Can Bitcoin mining increase renewable electricity capacity? Energy Economics, 115, 106143. https://doi.org/10.1016/j.eneco.2023.106143

Crypto for Innovation (2024). How is renewable energy stabilizing the grid for Bitcoin mining? Retrieved from https://cryptoforinnovation.org/how-is-renewable-energy-stabilizing-the-grid-for-bitcoin-mining/

DLA Piper (2023). The role of Bitcoin mining in renewables projects. Retrieved from https://www.dlapiper.com/en/es-pr/insights/publications/2023/02/the-role-of-bitcoin-mining-in-renewables-projects

Harris, J., & Duffy, M.P.J (2022). The role of blockchain technology in renewable energy: A systematic review of opportunities and challenges for the energy sector in the digital age. Journal of Cleaner Production, 351, 131458. https://doi.org/10.1016/j.jclepro.2022.131458

Khan, F., & Khan, M.A.S (2022). The impact of cryptocurrency mining on renewable energy consumption: Empirical evidence from selected countries in Asia-Pacific region using panel data analysis approach for the period 2010–2020.* Renewable Energy*, 186(1), 121–130 https://doi.org/10.1016/j.renene.2022.01.008

Küfeoğlu, S., & Özkuran, M. (2015). The impact of Bitcoin on the energy market: A case study of Turkey and the world energy market dynamics in the context of Bitcoin mining activities and energy consumption patterns.* Renewable and Sustainable Energy Reviews*, 50, 1137–1145. https://doi.org/10.1016/j.rser.2015.05.025

Menati, A., Zheng, X., Lee, K., Shi, R., Du, P., Singh, C., & Xie, L. (2023). High resolution modeling and analysis of cryptocurrency mining’s impact on power grids: Carbon footprint, reliability, and electricity price.* Energy Reports*, 9, 1–15 https://doi.org/10.1016/j.egyr.2023.01.001

Moreno-Munoz A (2021). Inequality built into the grid.* Nature Energy*, 6(852–853) https://doi.org/10..1038/s41560-021-00877-7

SSRN (2024). Economic integration of Bitcoin mining in renewable energy and grid stability. Retrieved from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4899244

14. Truby J (2018). Using Bitcoin technology to combat climate change.* Nature Middle East*. https://doi.org/10..1038/nmiddleeast..2018..75

15. United Nations (2015). Adoption of the Paris Agreement; Proceedings of the 21st Conference of the Parties; Paris, France.* United Nations*. Retrieved from https://unfccc.int/resource/docs/2015/cop21/eng/l09r01.pdf

16. World Bank (2019). Mini Grids for Half a Billion People; World Bank: Washington, DC; USA.

17. Zhao R., & Zhang C (2020). High-resolution modeling of the impacts of cryptocurrency mining on power systems: A case study of Texas.* Applied Energy*, 276(1), Article 115500 https://doi.org/10..1016/j.apenergy..2019..115500

18. Zhang, X., Li, Y., & Chen, Y (2021). The impact of Bitcoin mining on electricity prices: Evidence from the Texas market.* IEEE Transactions on Power Systems*, 36(5), 4450–4460 https://doi.org/10..1109/TPWRS..2021..3087348

19. Zhao, Z., & Wang, J.Y (2022). The potential role of Bitcoin mining in promoting renewable energy development in China: An empirical analysis using a dynamic panel data approach.* Renewable Energy*, 197(1), 123–134 https://doi.org/10..1016/j.retrec..2022..01